RIPEC regionalization magic show

|

| RIPEC Executive Director John C. Simmons speaks to Portsmouth residents. |

There is a straightforward descriptive piece to be written about the meeting of the Portsmouth Town and School Committees last Wednesday night with John Simmon and Ashley Denault, the main authors of the RI Public Expenditure Council (RIPEC) "Aquidneck Island Consolidation Feasibility Study." And in that kind of story, which would be suitable for a newspaper or other "objective" reporting venue, there would be all sorts of tables and graphs, telling quotes, and a smattering of audience questions to leaven the progression through an unremittingly grim economic analysis.

"We all know that the S3050 tax cap is squeezing the life out of our schools and towns," an Important Official Source in the the obligatory second-graf quote might note ruefully, "Yet we maintain the polite fiction that this is the best we could do."

This, however, is no such story. Let me say up front that I am, as School Committee chair Dick Carpender suggested, keeping an open mind. But I believe that transparency is the new objectivity, and to be transparent about where I'm coming from, I care first about the students. The numbers have to work, absolutely, but I want any decisions about our school system to be made in a rational, fact-based fashion, and in my opinion, the RIPEC presentation was a magic show. A very skilled presenter and his charming assistant treated the public to an evening of PowerPoint prestidigitation: look, over here — if you consolidate schools, 8 million dollars will appear!

|

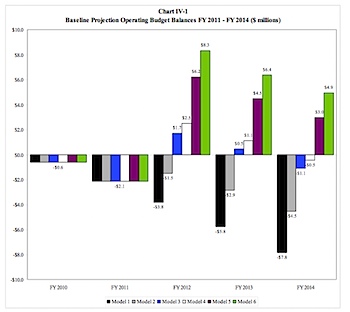

| Chart IV-1, page 92. (click to embiggen) |

Simmons, who spoke for about an hour to just 28 Portsmouth citizens and a quorum of both the Council and School Committees, returned repeatedly to the chart on the left, which shows the status quo (tax revenues under the current regime against expenditures) compared to the increasingly complete regionalization approaches, labelled Models 2-6 in the report. The sad gray rectangles below the baseline show projected deficits; the colorful bars above the X axis shows where you could "put that $8M back into education." Take no action? That black deficit bar means a "changed school system." This is both a burning platform for change and a drool-worthy lottery prize all wrapped up in one killer chart.

But like all magic shows, the RIPEC presentation relies on not looking behind the curtain. Because, off stage, what is driving the downward march of revenue projections (and the black bar) is the S3050 tax cap. There is an old proverb for paranoids: "If you get them asking the wrong questions, you don't have to worry about the answers." By taking as an unquestioned given that allowable increases on the tax levy will continue to shrink by a quarter-point each year, the RIPEC report makes a force of nature out of a legislative fiat.

For those who need a backgrounder on the S3050 tax cap (see discussion of tribbles here, and Sen. Paiva-Weed explaining it here and here), the core idea is that towns are limited by law in the amount they may increase the total tax levied, and that this total increase is being reduced by a quarter-point each year. Last year, the total tax levied by Portsmouth was $40,361,114, and since the S3050 cap was 4.75%, this year, for the coming budget, we were restricted to an increase to $42,278,267. Next year, we will be limited to a 4.5% increase, until we reach 4%, where we theoretically stay forever. These magic numbers don't reflect the real increases in costs that towns and school departments have faced.

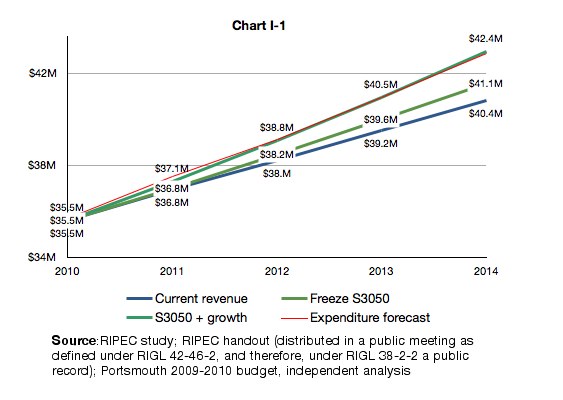

Before we even *think* about regionalizing, I believe it would be useful to consider what the numbers would look like if you froze the S3050 tax cap reductions. Not increased them, just froze them where we are at 4.75%. Oh, and for another scenario, what it would look like to allow towns to "keep the growth." Right now, as the tax base (the total taxable property value in town) increases, the tax rate an individual would pay goes down. Instead of a 4.75% increase, the effective tax rate increase is lower than what we should be paying under S3050. Taken together, these two measures seem to add up to just about closing the gap for Portsmouth, assuming salary increases held at the Consumer Price Index (CPI), the middle-range assumption from RIPEC's study.

|

| For more detail, see the spreadsheet on Google Docs. |

Here are my assumptions in creating this chart. For simplicity, I've assumed a 1% growth rate — a number based on data from the last three non-revaluation years. Computing the precise increase in tax rate requires adding the yearly new property value to the tax base ($3.2B), then working through what the tax rate would be on that, compared to how much the tax rate shrinks under the S3050 regime.

And, of course, I am assuming that it is possible to modify S3050, just as RIPEC has assumed that it would be possible to close Rogers one high school. Look, I know these are deviant assumptions, but that's one of the things that makes financial modeling art as well as science. My friend Adam's father, the respected economist Benjamin Chinitz (OBM), used to note the contingency of ingoing hypotheses with a laconic, "Assume a can opener."

That said, the data appear to suggest that if Portsmouth wanted to cover the costs of its school system, it could, if the state would let us. RIPEC tacitly acknowledged this in their presentation Wednesday night (in chart 17, they showed that levy increases of about 5% would be required).

Wouldn't it make sense for any regionalization plan to ensure that all the entities have the strongest possible balance sheets going in? Unrealizable savings are a fact of life in mergers, and coaxing the value from synergies requires a lot of hard work (work that will, theoretically, be done by less people.)

I completely agree with RIPEC on the current picture. We're in a hole, no question about it. But a purely economic argument for regionalization is like saying "if you only dig with two shovels instead of three, look how much slower you'll go. A school will disappear here, and savings will magically appear over there.

If there is enough political will to regionalize the Island, I respectfully suggest there should be enough to push the legislature to freeze S3050.

When you're in a hole, the first thing to do is stop digging.

Resources:

RIPEC

2009 Aquidneck Island Consolidation Feasibility Study

I would have linked to the presentation from Wednesday night, but despite promises from the presenter that it would be posted "tomorrow," as of Sunday, 9-27, I still could not find it on the RIPEC Web site.

Full disclosure: I don't like taxes any more than you do. I'm not suggesting we pay more taxes. But I am suggesting that we not pay less. Also, the central metaphor of making things disappear in one place and appear in another will be familiar to those who have seen The Prestige. You can smile knowingly as you consider what happens to things that are magically teleported...