Whitehouse and Warren take aim at abusive credit card rates

|

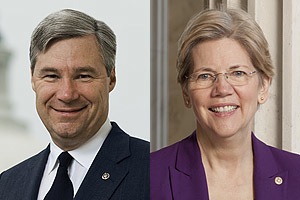

| Senators Sheldon Whitehouse and Elizabeth Warren. Photos from senate.gov |

Rhode Island Sen. Sheldon Whitehouse (D-RI) teamed up with Sen. Elizabeth Warren (D-MA) to introduce legislation today that would restore states' ability to control abusive credit card and consumer loan rates, according to a joint press release.

The "Empowering States’ Rights to Protect Consumers Act," would protect consumers from excessive consumer credit rates by restoring interstate control over lending rates stripped from state legislatures by a 1978 Supreme Court decision. In that case, the court ruled that national banks were only bound by the lending laws of their home state, allowing credit card companies to choose headquarter locations that permitted interest rates as high as 30% or more.

“It’s time to stop Wall Street banks and their credit card subsidiaries from taking advantage of struggling families in Rhode Island and across the nation,” Whitehouse said in a statement. “This legislation would restore historic, long-standing states’ rights to protect consumers from improperly high interest rates.”

“We need to ensure states have the ability to enforce their own rules against lenders doing business within their borders,” Warren said in the statement. “States should be empowered to take action to protect consumers from tricks and traps buried in the fine print by credit card companies.”

The bill introduced by Whitehouse and Warren would amend the Truth in Lending Act of 1968 to clarify that all consumer lenders -- regardless of their location -- must abide by the interest rate limits of the states where their customers live.

Rhode Island had a state-level interest rate cap for many years, but abandoned it after the Supreme Court decision; the Whitehouse-Warren bill would allow Rhode Island to reinstate a cap.

Editorial note: Written from a press release.